Almost 940,000 Americans have unclaimed tax refunds from 2020. The IRS is urgently calling these taxpayers to file their returns. They face a pressing deadline of May 17. Missing this deadline could result in a loss, and nearly $1 billion in refunds could slip away.

Urgent Call to Claim Unclaimed Refunds

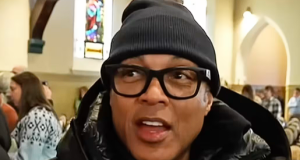

Discovering unclaimed refunds has set off alarms across the nation. IRS Commissioner Danny Werfel makes a pressing appeal to taxpayers as the May 17 deadline nears. The extension has come about due to the COVID-19 pandemic. This is the final chance for taxpayers to claim their refunds. Ignoring this opportunity leads to the forfeit of the funds to the U.S. Treasury.

COVID-19 resulted in extensive delays in tax filings. Individuals across different sectors, including students and part-timers, didn't claim their refunds. Werfel underscores the need to review personal tax records thoroughly. He urges immediate initiation of the tax filing process. He insists on avoiding procrastination at all costs.

What Happens If You Miss the Deadline?

Taxpayers are usually given a three-year filing window. If this period is missed, refunds are forfeited and sent to the U.S. Treasury. This year's May 17 deadline is significant. It closes the 2020 tax year window and underscores the urgent need for timely taxpayer action.

Moreover, non-filing results in a dual loss. Taxpayers forfeit not just their refunds but also miss out on possible key financial benefits like the EITC. In 2020, the EITC could provide up to $6,660 to those eligible. This is a major boost, especially for individuals with low to moderate incomes.

Who Risks Missing Out?

Among those facing significant risk are high-income individuals who didn't file taxes. They're now under the scanner due to IRS compliance actions. Backed by the Inflation Reduction Act, new initiatives target these taxpayers. Over 125,000 high-income taxpayers could face actions for not filing returns.

A significant proportion comprises individuals with over $1 million in income. Over 25,000 of them are in this bracket. This showcases the IRS's intense efforts to ensure tax compliance, which impacts all income levels.

How Can You Claim Your Refund?

For those yet to file, various options are available to gather the necessary documents. Resources are readily available from requesting copies of

- Forms W-2,

- 1098,

- 1099, or

- 5498

For 2020, 2021, or 2022 from employers or banks to using the IRS's Get Transcript Online service. Taxpayers are encouraged to start this process early, ensuring they have ample time to file before the deadline.

What Are the Statistics by State?

Each state has unclaimed refunds waiting. A comprehensive state-by-state breakdown provides insight. It shows both the number of individuals and the median refund possible. The table from Alabama to Wyoming is below. It stresses the need for quick action by taxpayers across the country.

This table represents the widespread impact of unclaimed 2020 tax refunds nationwide. From Alabama, where an estimated 21,700 individuals potentially missed out on $848 each, to Wyoming, where 3,100 individuals could claim a median refund of $944, the scope of unclaimed funds is vast.

Why Is This Announcement Significant?

An astonishing $1 billion remains unclaimed in tax refunds for just one tax year. This highlights the crucial need for enhanced taxpayer education and interaction. The situation points to an often missed chance. Eligible taxpayers could recover funds to help them, particularly in challenging economic periods.

The deadline nears with over $1 billion at stake, and the IRS's call to action becomes increasingly pressing. The opportunity to claim taxes and significant tax credits like EITC should motivate taxpayers across the U.S. to review their filing status and act promptly. As May 17 approaches, the window to claim these funds draws closer to closure, emphasizing the importance of immediate action to ensure no taxpayer leaves their due money unclaimed.